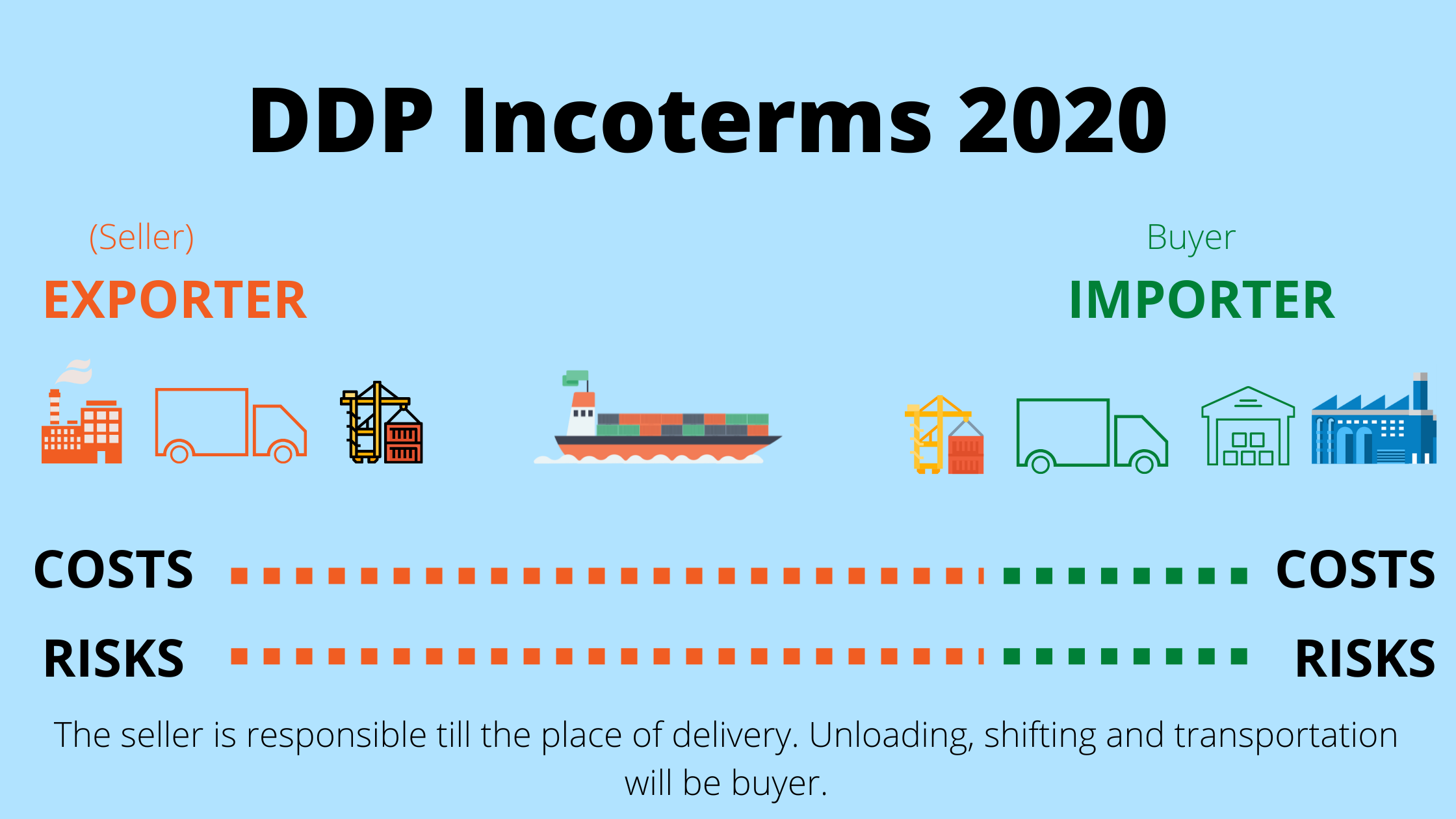

Delivered Duty Paid (DDP) Incoterm 2020 is the term used in incoterm that is the most suitable for the buyer since the seller is carrying the full responsibility. In the DDP delivery terms, the seller is responsible for the maximum amount of responsibility while the buyer is subject to minimum risks and responsibilities.

In the case of DDP, the seller takes care of everything, which includes import clearing at the destination, which is where the buyer only arranges for unloading at the point of delivery. In other words, you can use the term DDP incoterm, except for unloading at the point of delivery (which is coordinated by the buyer). The seller is in charge of everything.

Costs based on DDP Incoterm 2020:

All expenses are to be paid by the seller. The only expense borne by the buyer is the cost of unloading at the point of delivery. DDP Incoterm 2020 contract risk:The risk is the seller’s when they carry out every operational activity.

Insurance policy as per DDP Incoterm 2020:

The seller offers an insurance contract under DDP Incoterm.

Example of DDP Incoterm 2020:

Using an illustration, we will learn about DDP incoterms. Let’s suppose an importer from Mumbai, India (buyer/importer) is in need of PVC tiles (flooring materials) and they search for manufacturers (sellers/suppliers or exporters) all over the world and find a good one located in Seoul, South Korea, who is the manufacturer of PVC flooring tiles located in Seoul.

The Indian distributors forward their needs and request quotations with a request for a quote to the PVC carpet tile producer. The distributor also requests the manufacturer to send a few samples. According to the request, the supplier provides a few samples of tiles and also provides the product’s details as well as their pricing range. When the tiles are received, the buyer reviews all factors like the quality of the product and thickness, colour texture, pattern, and so on. and chooses 3 options.

The seller/supplier will send a quote for the tile that is shortlisted, and both parties will go through several discussions on the price. Buyers in India don’t know much about international trade.

They don’t even have the resources to handle the task since they have been entirely dependent on the local market until now, and this is the first time they’ve made the decision to import. This is why they want the products to be delivered to their warehouse in a timely manner and do not wish to be entangled in the import process. They prefer to cover the cost as they ask the suppliers to deliver the goods to the buyer’s warehouse.

The supplier quotes accordingly and then both parties settle on a cost, also called a DDP price. The parties have agreed to pay 50 percent in advance and the remaining 50 percent at the time of delivery.

The seller also communicates the date of readiness for finished goods (ex-factory date) to buyers. Contract in accordance with DDP Incoterm 2020:In accordance with the buyer’s and sellers’ verbal agreement, the contract is written and contains all the conditions and terms as well as a description of the item price, cost, incoterms, shipping method, and other details.

DDP (Delivery Duty Paid)Buyer’s warehouse, India The payment term is 50% in advance and 50% prior to delivery. Both parties (Seller & Buyer) sign the contract. The buyer issues a purchase order to the seller.

The seller begins production once the contract has been signed, so they can ensure that the manufacturing of PVC tiles is completed by the readiness date, which is provided to the buyer.

The seller then contacts a freight forwarder with good contacts in India as well, since the forwarder has to coordinate the logistics at the destination, including customs clearance. The freight forwarder makes bookings for the containers at the same time they talk with their counterparts from India and issue a work order for all the activities at the destination.

When production is complete and quality checks are completed, the finished products are brought to the packing facility, and once packing is complete (the packing method used for this tile is a carton box with palates made of wood), the tiles are delivered to the loading dock.

In accordance with the contract, the forwarder takes the containers to the premises of the supplier, and the goods are then packed into containers and shipped to the ports. The clearing agent presents all documentation for customs clearance and also coordinates customs clearance. If everything is satisfactory, customs will clear the cargo, and containers will be delivered to the terminal for loading onto the vessel.

The vessel is sailing according to the schedule, forwarder, and share confirmed on board, and then ships on the date of the board to the shipper. It then approaches the shipping line to obtain a bill of lading. The shipper and their clearing agent go to different offices at the same time to get other documents for post-shipment.

Documents were issued:

- commercial invoice

- List of packing materials

- A Bill of Lading

- Certificate of origin.

- The phytosanitary certificate

- Fumigation certificate

- Certificate of insurance

- Additional documents

If they exist, After the above documents have been received, the supplier will send copies of the documents and original documents to the counterpart of their freight forwarder or agency in India. They also send buyers copies of the documents and check the ship’s sailing date and estimated time of arrival (ETA).

After the courier is received by the agents in India, they forward the same to the CHA (Customs House Agent) chosen by them. Following the arrival of containers at CFS, CHA contacts the liner’s office and requests a delivery order by submitting the original Bill of Lading and the destination liner charge (THC).

After that, they contact customs officials in CFS and send the complete file associated with the shipment. Generally, the file includes documents like the original post-shipment documents that were received from the source and a verified copy of the Bill of Entry, as well as a challenge for duty payment.

Customs officials review the documents and conduct physical confirmation of the cargo, and when they are satisfied with the cargo, then they issue an out free. The word “out of charge” means customs clearance has been completed and the shipment can be taken away.

Once the clearance has been completed, CHA informs the Indian agent, who arranges for vehicles to transport the items to the buyer’s location in Mumbai. After the vehicles have been parked on the road, goods are taken off of containers and loaded onto trucks.

Containers that are empty are delivered to yards. The goods are transported to the buyer’s location according to the delivery terms, and at this point, the selling responsibility for the goods ceases.

The buyer organises the unloading of trucks and signs the document POD (proof that the goods have been delivered). The POD document is given to the seller by its agent. Once the purchase is made, the buyer pays the remaining 50% and then shares the SWIFT copy.

All this is about DDP incoterm and we hope the above article would have helped you to understand what is DDP shipping and the operation mode. If you have any consultations required for air freight, ocean freight, customs clearance, and Logistics transportation then we have a very committed team of professionals to help you out. You can get in touch with us at Consolidation Shipping Line any time of the day or drop an email at inquiry@cslindia.net